Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

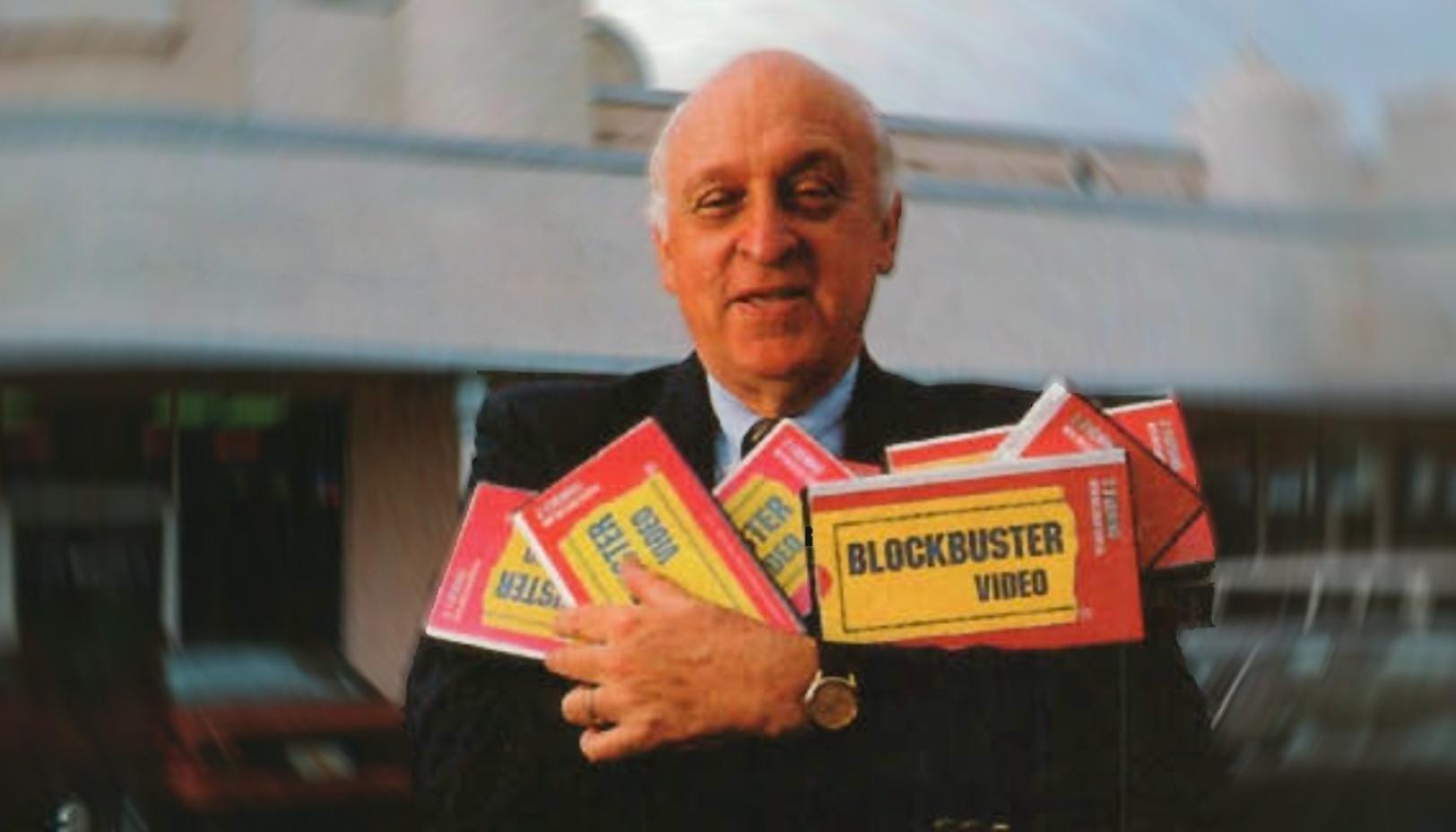

"Call Charlie a lucky man for stumbling onto Cook Data Service, but luck didn't make him a millionaire."

It was the 150-Bagger in the title of Peter Lynch's 1994 article 'Charlie Silk's 150-Bagger' that caught my attention.

Here's the back and forth in my head as I was reading it:

Ok, how'd he find it - he got lucky right? Sure there was some luck involved, but he was fishing where the fish are.

Alright, how'd he know he was looking at a 150-Bagger? He didn't know, no one can see that far, but the ingredients were there and the stew got better over time.

How'd he do his diligence - was the CEO a friend/family member? He did what we all do - he analyzed the size of the market, looked at the shareholder list, talked to the company, went to the stores and saw how crowded they were.

So he coffee-can'd it and the beanstalk sprouted magically? He was active, spending a few hours every month tracking the growth in stores, tracking whether people were still flocking to them, looking at what was changing.

He held through the crash of '87 and large draw-downs - did he have a meditation routine? He'd followed the company since the beginning and knew the company so well, it would have taken a lot to separate this man from his well-reasoned conviction.

You know what - good for this huckleberry. This article was written three decades ago. Blockbuster isn't even around anymore. Wasn't the game a lot easier back then? All true - but here's a quote from the article: "volume is something Charlie watches very closely. In his experience, stocks on the way down usually don't hit bottom until the volume has subsided. Heavy volume in the upward direction is often a harbinger of more big moves." Tell me you don't see this in the market today.

This evergreen article is inspiring and a worthwhile read. After reading it, how can you not be romantic about microcaps.

View Article Below:

This is one of my favorite lines:

"Call Charlie a lucky man for stumbling onto Cook Data Service, but luck didn't make him a millionaire. The hard part was holding on to the stock long enough to get the full benefit. After the price had doubled and then tripled, he didn't say to himself, I'll take my profits and run, like many investors who invent arbitrary rules for when to sell. He wasn't scared out when the price dropped, as it did several times, and he ignored the highly publicized negative comments made by forecasters and "experts" who knew less about Blockbuster than he did. He had the discipline to hold on as long as the fundamentals of the company were favorable. It was not a guess on his part. He was doing his homework all along." - Peter Lynch

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.