Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

John Mackay was born in Dublin, Ireland in 1831. At the age of 9, the Mackay family immigrated to the US, living in the notorious Five Points in lower Manhattan, which was known as the worst slum in the United States.

John was lucky in that his parents scraped together enough money to send him to school, only him. His schooling only lasted for two years, when his father suddenly died, and John, at age 11 had to quit school to work to support the family. He was somewhat lucky in those two years because he learned how to read and write. This was the only formal education he would ever receive in his life. He would work selling newspapers for the next four years and then became an apprentice at a ship builder for another four years.

The Mexican–American War took place from 1846 to 1848. Nine days before the treaty was signed between to the two countries whereby the US was given California and New Mexico, gold was found in a riverbed in California that would spark the greatest gold rush in history.

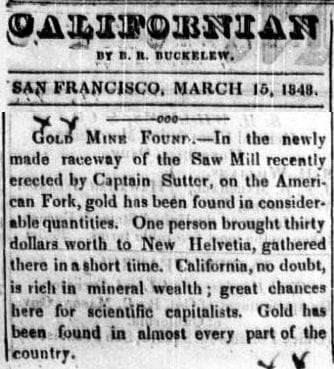

Gold was discovered on January 24, 1848 by John W. Marshall, a carpenter and sawmill operator who worked at Sutter’s Mill, owned by pioneer and German-born immigrant John Sutter. Sutter tried to keep it quiet but the news broke by March.

It would be a few months until news of the gold discovery hit New York, and a few months more before the excitement really hit. The trigger point were articles written about mining laborers making $50-70 per day which was 50x what a normal unskilled laborer made in the United States.

Tens of thousands of people started flooding into California and the gold rush was the main catalyst that kickstarted people moving from East to West during that time period. But during this time Mackay stayed at the shipyard earning $1-2 per day.

When you think about the California Gold Rush and how it ignited an excitement that pulled so many people West I think it’s easy to think these people were dumb, undisciplined gamblers. But put yourself in the position of a common unskilled laborer making $1-2 per day here in the United States in the early 1850’s. There were no advancement opportunities. Your best case scenario as an unskilled laborer was in 10 years you would be doing the exact same thing making the same amount of money. That was your upside.

What would you do? Stay at home making $1-2 per day for the rest of your life or go west and see if you can make 50x more. You too would be on the next horse/boat out of town.

By late 1851, a solid 2-3 years into the gold rush, Mackay quit his apprenticeship, boarded a ship, and headed for the west coast. He was late to the gold rush. By this time there would have been thousands of people already coming back East from the Sierra foothills empty handed. The easy pickings were picked and by late 1851 the cost of living had exploded in and around the gold rush.

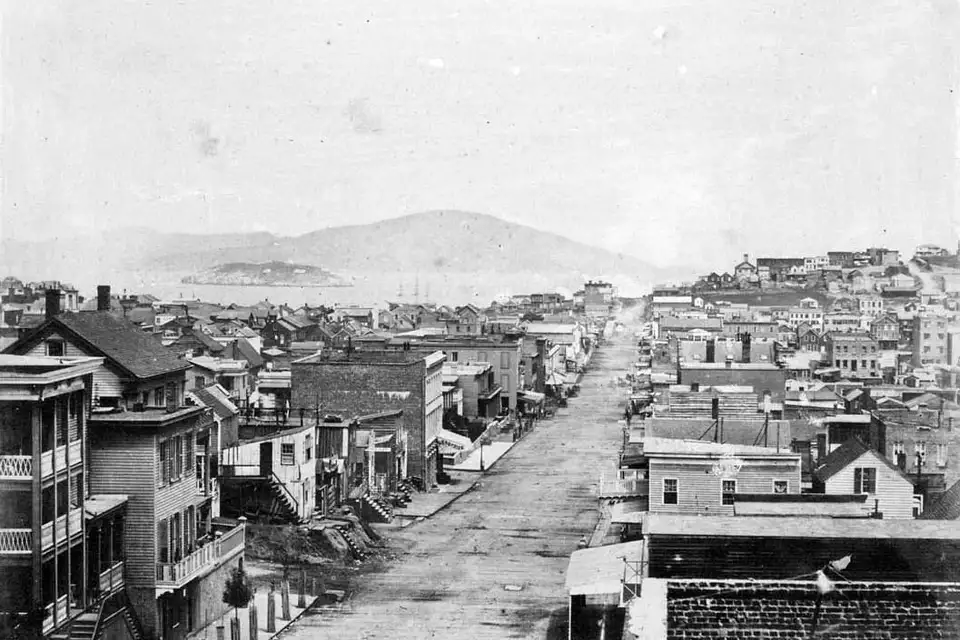

In three years, San Francisco went from 800 people to 35,000 and became the fastest growing city in America. San Francisco became the melting pot of culture – you could hear English, Spanish, French, German, Chinese, Malay, and Hawaiian all spoken on the same city block. San Francisco was a place of new beginnings, because the city itself had no past.

But at the same time, anyone that came west with a moral compass, left it on the boat. Mining was extremely hard, and the outcome was much more like gambling. Many people went broke. Disease was rampant in mining towns. Alcohol and gambling were the main distractions. Violence and murder were common day behavior. Drinking, gambling, and gold were the top three endeavors. California quickly became the devil’s playground.

When Mackay landed in San Francisco in late 1851 he went straight to Downieville, California (100 miles north of Sacramento). He lived there for seven years mining gold in the gulches. He never made a big strike during these years, but he earned enough to support himself and send what he could back to his mother and sister.

Mackay actually loved the life – the outdoors, the physical work, the camaraderie, the chaotic menacing life of the mining camps. In his first few years Mackay built a hard working reputation. No one worked harder than he did. He was well liked among his peers. What made him different was at night when everyone drank and gambled, he stayed home and read about mining, geology, and also studied great men. He visualized himself in situations competing and winning.

In Downieville, at the start of the gold rush if you worked with a good team, you made $20 per day. But the pay was steadily coming down as the easy gold was taken out of the earth. By 1855 miners made $5 per day, and by 1858, you were lucky to make $3 per day.

By 1858, Mackay was 27 years old and had been mining seven years with nothing to show for it. He was working hand to mouth just like the first day he arrived. The Downieville gold district was dying, and it was time to make a move. Mackay and a friend packed up and literally walked 110 miles to Virginia City in Nevada that would later become the Comstock Lode.

It’s hard to imagine that within 20 years John Mackay would own the entire district and become one of the richest men in the world. If you would like to learn more about John Mackay read this amazing book.

I often think about the perseverance it takes to become who you want to be, and how it doesn't happen by accident. It is the result of deliberate thought, effort, and discipline. Mackay studied while everyone else drank and gambled. His effort in self-improvement wasn’t a guarantee he would become successful. But he would have surely guaranteed himself to be poor if he hadn’t put in the hours that others wasted.

I think this is a valuable lesson for life, business, and investing. I was reminded again by this after watching this wonderful presentation by Shyam Sekhar. He outlines his maturation as a stock picker over the past 30-years.

"When you make a lot of money ahead of when you should have it is your duty to grow yourself first and then handle that money. You need to grow yourself ahead of your portfolio." - Shyam Sekhar

I love the concept of growing yourself ahead of your portfolio. It reminded me of an article I wrote seven years ago, The Maturation of an Investor. We all want instant fame and fortune, but the problem with instant success is you rarely have the power to keep what you haven’t earned. Almost all successful people went through incredible hardship, obstacles, and challenges. The ability to grow yourself and prepare for success ahead of it occurring is the winner’s quality.

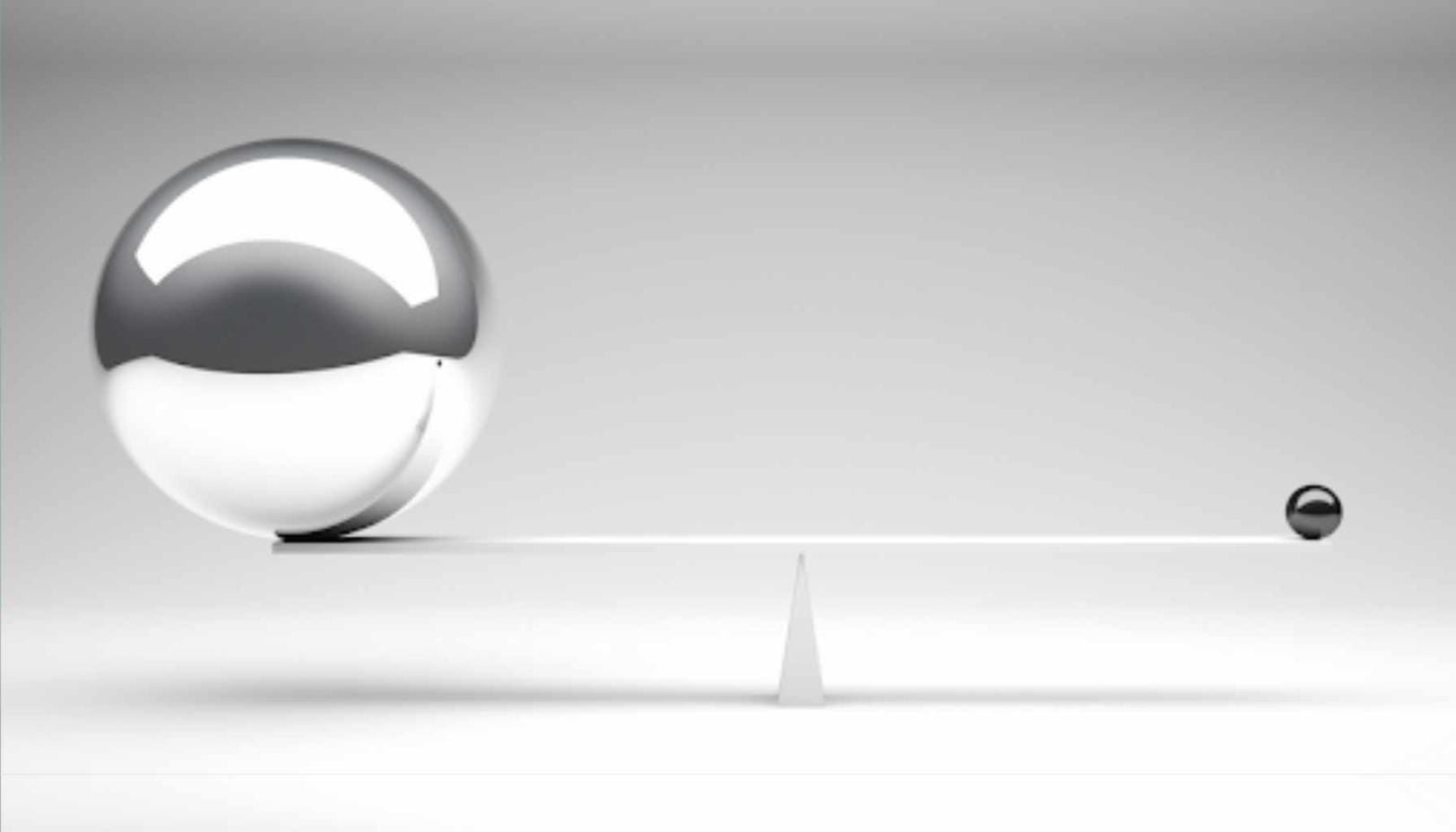

The hardest part of achieving a great long-term investment track record is over half the time your returns will look average. You can go years where it feels like you are working hard for mediocre returns. Then all of a sudden it changes and the previous year’s efforts, perhaps helped by a better macro environment create circumstances where you don't have to work as hard for your returns. The world works for you and pulls forward 5-10 years’ worth of returns and riches in a single year.

Then it’s up to you if this will be a permanent step change in knowledge and wealth. Is this your new base in which to grow from? Or will you stop growing yourself by letting your ego take control thinking you know everything. Will you revert slowly and then quickly back to immature tendencies? If so, your wealth will revert slowly and then quickly.

The growth and maturity to manage $1,000,000 is different than $100,000. The growth and maturity to manage $10,000,000 is different than $1,000,000. You must always be growing yourself ahead of your portfolio.

Grow yourself.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.