Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

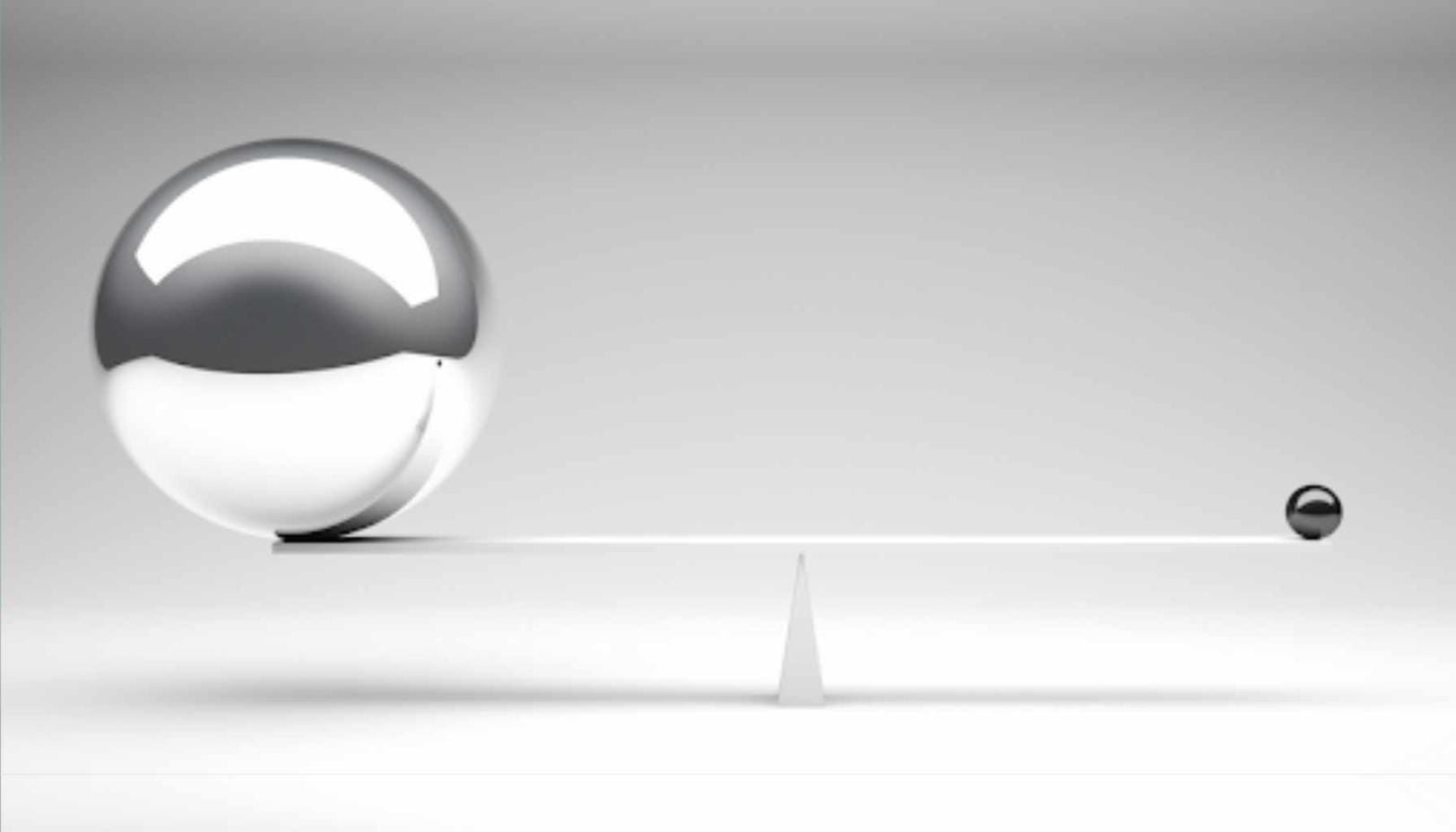

Whether you agree or disagree with someone, you always respect them for putting their money where their mouth is. It isn’t courage unless you have skin in the game. It isn't courage unless you're willing to lose something. Many have opinions. Few have courage.

In the early 2000's, when I was learning how to invest in microcaps (aka losing money) I stumbled upon the person that would become my first mentor. I met him virtually on a public stock message board and he would later take me under his wing and teach me.

He was a full-time gambler, literally. When I first met him he lived in Florida, and a few years later he moved to Las Vegas so he could gamble every day. He was loud. He was authoritative. He had a radio announcer's voice. In his previous career he trained stock brokers.

He was cut from the cloth of the 1970's and 1980's stock markets. When Type A personalities ruled and were respected. When the Michael Steinhardt's of this world with their "I'm your competition" and "I'm right You're wrong" mentality was the norm. No touchy feely "we can all win together" like it is today. It was a different time of different men.

I grew to love that about him. The certainty. The conviction. The willingness to piss people off at any moment if he disagreed. The type of man that will stop a conversation mid sentence or get up from a dinner table and end a 30 year relationship if certain lines are crossed. The type of man that has a lot of colleagues but few friends. These personalities are lightening rods and you just get ready to hear the crack.

But their personality is also what you respect about them. You know exactly where they stand and where they stand with you. I didn't agree with him all the time or how he lived his life, neither did his three ex-wives, but I loved him nonetheless.

The first day I met him, he picked me up at the airport in a silver porsche and we went straight to a casino. He loved the action. He knew all the dealers by first name and they knew him. Watching him play craps was like watching a master conductor lead an orchestra. It was like magic.

In college I would fly to his house every month or so and stay the weekend. We would talk stocks and he would put me through the gauntlet. I think he missed training brokers, so I became the person he trained. He had no patience for "uhmmmms" or "I thinks" or half convictions. There was no gray. It was only black or white. A stock was either a buy or a sell when you owned it. Never a hold. A hold just meant you couldn't make up your mind so it was a sell.

He was the first conviction investor I met. He owned 4 stocks and spoke to management frequently. Like any mentor-mentee relationship his best four ideas became my best four ideas and so we started traveling to meet management teams together. I had a system down where I would only miss one day of college classes, but be able to make it anywhere in the United States to make a meeting or dinner. Late nights and red-eye flights.

He was insanely good at getting people to like him. He would say, “There is no money to be made being an asshole. People tell you more when they like you.” He was extremely likable. He just wasn't lovable for most.

He would normally take the lead in conversations and meetings, and at dinner have a few cocktails with the CEO's while I took notes. I remember one night I flew into Pittsburgh (a short flight for once) and his flight was cancelled. I took the lead with the CEO and I had a few cocktails. I didn't know how a person could do both those things at the same time and remember anything. Well it just took practice is what I learned.

The other thing he taught me was “skin in the game.” He had no interest in hearing about stocks I thought were interesting. He only cared about stocks I owned. He only cared about what I was doing, not what I was saying. I still remember it like it was yesterday, but one of the first stocks I pitched him. He asked me, “Do you own it?”, and I said, “No”. He put in finger in my chest and looked me dead in the eyes and said, “This world is full of analysts and not enough investors. Put your money where your mouth is or shut your mouth.”

He would share his stock ideas via email to a list of a hundred or so people. I would meet half of them in person over the next few years of traveling with him. They probably ended up making a little more money than they lost, but even after the big losers they still respected him. They knew he had 10x more skin in the game in each idea.

He also lived by a certain code. When he was young he went to West Point, and his father was a General. Those values stayed with him. He may have been the first one into his stock ideas, but he was always the last one out. He would tell a few of his closest colleagues, "I'll hold the door open when we leave and shut it behind us". That was his code and it was hard not to respect it. It lead him to make more on some stocks but lose a lot more on many others.

Toward the end of his life we grew apart because I kept evolving and he stayed how he was. Any normal person would have cut ties with him completely, but I loved him too much. Mentors don't have to be perfect, they just have to teach you something. He taught me the things I needed to learn. Over the years you realize people come into your life for a reason. They are meant to show us what we could or shouldn’t let our lives become. Often seeing the bad is just as educational as seeing the good.

It was 10 years after I had first met him. The years and decades of hard living finally caught up to him. Years of gambling would strip him of almost all his wealth. His health began to fail. His son called me and told me his Dad's health was getting worse. It ended up being a false alarm but I didn't know. I was married, but I jumped on a plane. I showed up on his front door step.

He opened the door using a walker. He could barely walk, but he still had that personality. That baritone voice you could hear across the room. He still had that spark. The type of person that if you met him for the first time, within 5 minutes you would have thought, "I wish I could have met him 30 years prior to see what he was like."

After we embraced I held up an envelope with $10,000 in cash and said, "Let's go gambling." His eyes lit up. It's like I rewound time 10 years back when we first met. Back when I knew nothing and I thought he knew everything. It was the best money I ever lost.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.