What’s a quick way to annoy an investor?

Write: “If you bought $1,000 of [insert 1,000x multibagger] stock 30 years ago and still owned it, you’d have $1 million dollars.”

You can make a ton of money investing in great companies early and holding. However, these clichés oversimplify the myriad of factors that contribute to holding such a company. In reality, life gives us every reason to sell a great company. Consequently, investors experience wildly different results despite investing in the same stock.

Take Apple, for instance.

Of the three original co-founders of Apple, only two individuals became rich: Ronald G. Wayne was not one of them. He sold his 10% stake in Apple for $1,500 just two weeks after the company’s founding in 1976. Steve Jobs and Steve Wozniak fared much better. Jobs sold all but one of his millions of shares of Apple in 1985, yielding him hundreds of millions of dollars. Steve Wozniak lost 15% of his shares in the separation to his first wife and either sold or gave away the rest of his Apple shares by 1985, resulting in a number of millions for him.

Same stock; wildly different returns.

Why did Ronald Wayne sell so early? During the initial week, Jobs successfully secured a contract to sell 100 Apple Is to the Byte Shop, a firm notorious for not paying their bills. To fulfill this order, he obtained a $15,000 loan. Given Apple’s non-corporate status at the time, Ronald Wayne found himself personally liable for $1,500 should the Byte Shop live up to its reputation– a sum beyond his means. Wayne, having recently navigated his own prior corporate failure and spent years repurchasing stocks and settling debts, couldn’t bear this financial risk. His decision was firm, as he believed it would have likely led him to a mundane paper pushing role than allowing him to pursue his inventive passions. He didn’t regret his billion dollar decision.

Apple is a $3 Trillion market cap today and all three founders sold most or all of their stock by 1985. Investing is hard.

Mike Markkula was the first and one of the longest holders of Apple stock - out holding Jobs and Wozniak. Markkula invested $91,000 in equity and secured $250,000 in financing, acquiring a 33% stake in the company. He played a pivotal role in guiding Apple in various capacities, eventually becoming Apple’s longest serving board member. Over time, Markkula sold his stock and by 1997 was Apple’s second-largest individual shareholder, possessing 3.1 million shares valued at $40 million–a >500-bagger. He likely continued to hold shares after his retirement as he said he was optimistic that Jobs could help restore the value of the stock and the company.

Apple raised their first venture capital round in 1978. Venrock invested $288,000 for 10%. Sequoia Capital invested $150,000 and Arthur Rock invested $57,600.

Approximately two years later, just before Apple’s IPO, Sequoia Capital–a venture firm established by Don Valentine–sold their stake for $6 million, a 40-bagger. Allegedly, the reason behind Sequoia’s divestment at that time stemmed from certain LPs urging Don Valentine to liquidate profits to cover taxes. [This is the main reason why Sequoia now only accepts money from non-profit tax-exempt sources and sticks with companies long after a company’s IPO.]

Arthur Rock, one of the forefathers of venture capital, became a board member of Apple. At Apple’s IPO, Rock’s shares were worth $21.8 million, a 378-bagger. Rock was selling large blocks of shares in 1983. By June 1993, Rock had stepped down from the board and sold most of his remaining holdings.

Arthur Rock’s departure from the Apple board and last sale of shares boil down to one pivotal moment. When Apple, IBM, and Motorola jointly took out an ad in all of the newspapers announcing the PowerPC chip, declaring that they’d kill Intel, it posed a conflict for Rock. As an early investor in Intel and a board member, he remarked, “Of course, I had to resign.”

Same stock; wildly different returns.

Venrock, the venture arm of the Rockefeller family, participated in Apple’s second venture round, diluting its 10% stake to 7.9%. Venrock sold out of its position a few years after Apple's IPO for a 430-bagger return. The reason? To invest in other opportunities.

Henry Singleton bought $100,800 in Apple during its second round and became a board member of Apple. Singleton co-founded Teledyne in 1960 and as Warren Buffett stated “ [he] created the best operating and capital deployment record in America” by 1980. Singleton upped his investment in Apple in later rounds for a total investment of $302,800. By Apple’s IPO, Singleton’s 2.4% stake was worth $40.8 million, a 134-bagger. Like Rock, Singleton was selling large blocks of shares in 1983, largely to fund his land acquisitions.

The venture arm of Continental Illinois Bank in Chicago invested $504,000 in Apple’s second round of funding. During the IPO in 1980, the firm sold $5 million of the position, resulting in a 78-bagger in 28 months. The remaining 1.5 million shares were sold not too long afterwards. The reason for the sales? It helped contribute to the bank’s overall earnings.

During Apple’s third capital raise round, in August 1979, Alan Patricof’s Fifty-Third Street Ventures invested $315,000 in Apple. A short 16 months later, Patricof’s investment was worth $5 million, a 17-bagger. Patricof sold $1 million on the IPO day. He said it was an easy chance to “get the bait back.” He distributed the Apple shares in-kind to his investors, who likely sold their shares immediately.

Same stock; wildly different returns.

After Apple went public, many Apple employees became multi-millionaires on paper. Some, like Jef Raskin, sold their shares because they “didn’t want to have to open the paper each day to find out how much money” they had. Many others sold to retire and live extravagant lifestyles.

It’s plausible to assume that the 1,000s of individuals who invested in Apple’s IPO lost money. From the IPO to Steve Jobs’s departure in September 1985, Apple stock declined 47%.

Surely, there must have been individuals who invested in Apple’s IPO and held it until 1983 when shares went up 300%, like many of the early large investors, or possibly longer. However, it’s probable that the majority of investors did not.

Then you have retail investors like Donna Fenn who invested in Apple in 1985. Aside from selling some shares in 2009, she continued to hold shares until 2018 [HERE].

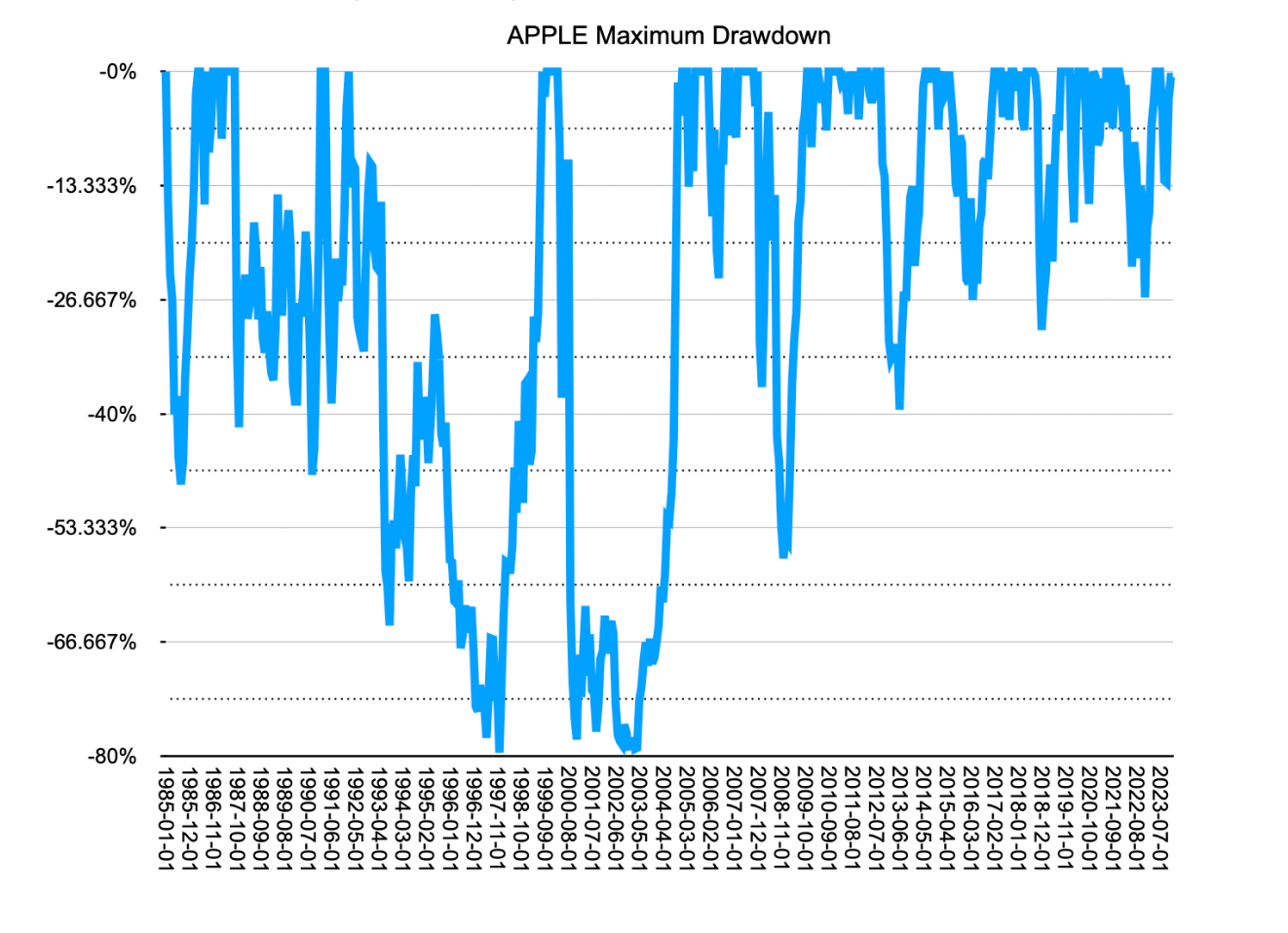

Again, it’s safe to assume that many people lost money investing in Apple while a much smaller number made a profit, and an even smaller number made a killing. Here are the drawdowns from Apple’s highs since 1985.

-20% or more - 224 months (~48% of time)

-30% or more - 167 months (~36% of time)

-40% or more - 124 months (~27% of time)

-50% or more - 94 months (~20% of time)

-60% or more - 69 months (~15% of time)

-70% or more - 33 months (~7% of time)

To have made a killing investing in Apple in the 1990s would have been difficult. For much of that decade Apple’s business was a loser. If you bought Apple stock in 1990, it would take nearly a decade to break-even before it skyrocketed higher.

Most Apple investors were like Ted Gioia, a jazz critic, who purchased 300 Apple shares in the 1990s and sold them in 1997 for $9,100. Had he not sold, his investment would be 700 times larger. He recalled:

"I probably should have bought those shares back when Jobs returned to Apple. And eventually I did buy a few shares, and made some profits — but they were tiny compared to the gains I could have enjoyed just by holding on to my original investment."

The people on the other side of Gioia’s trade were investors like Saudi Prince Alwaleed bin Talal Alsaud who started buying Apple in 1995 (~$0.35), and held as the stock fell to a split adjusted $0.11. In 1997, the Prince increased his position to 5% of Apple’s shares as Steve Jobs returned to Apple as CEO. The Prince held at least until 2011, when he paid the following tribute to Jobs at the time of his death:

“I knew Steve Jobs for the past 20 years. When I first invested in Apple the share price was $9! I met him three times at Apple’s offices and had lunch with him once. …I remember him saying to me ‘Prince, you trusted me in investing in Apple & [I] won’t let you down. Well, he didn’t let anyone down!!! Three apples changed the world: Adam’s, Newton’s and Steve’s!”

Same stock; wildly different returns.

After Apple’s business demonstrated significant success with the advent of the iPod, iPad and groundbreaking iPhone, investors started making money. In 2013, Carl Icahn began buying Apple’s shares. He ended up buying 45.8 million shares as he called the investment a no-brainer. Over the next 3 years, he said that he made roughly $2 billion, or roughly a 2-bagger. Icahn fully exited Apple in Feb 2016 despite the stock being cheap on a multiple basis. He said:

“[The Chinese government could] come in and make it very difficult for Apple to sell there ... you can do pretty much what you want there.”

At about the same time Berkshire Hathaway began buying shares in Apple. Berkshire initially purchased 9.8 million shares. Over the next 3 years Warren Buffett purchased another 241 million shares (pre-split) for a 5.2% interest in Apple. Berkshire’s cost basis was ~$36 billion. Despite selling some shares in Apple in 2020, which Buffett and Munger later called a mistake, Berkshire has made roughly $190 billion (as of 12/17/23) on its Apple stake, a 6-bagger.

Same stock; wildly different returns.

I'm reminded of this comment by Ian:

The beauty of investing is 1000 investors can be in a multi-bagger stock and returns will be dramatically different - some will lose money. Finding a great company isn't even half the battle. Time horizon matters. Temperament matters. Conviction matters. Price paid still matters.

— Ian Cassel (@iancassel) September 11, 2023

There’s only one reason to buy a stock, but there are infinite reasons to sell a stock.

Discovering the next 10-bagger is crucial, yet it’s not as insurmountable a task as many presume. The most challenging aspect of investing in a 10-bagger lies in prematurely selling the stock.

Since 2011, MicroCapClub members have profiled fourteen >10-baggers and one 100-bagger. Many market participants invested in these same winning stocks, but each got wildly different results.

I can speak from experience that MicroCapClub has helped me hold onto a few winners much longer than I would have without it. It’s the place where you can learn from investors who know the business better than most.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post