Shelf Life

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

Building conviction is the same thing as building a relationship. Time and effort are necessary ingredients in all great relationships.

Relationships and stock selection have a bunch of similarities. When you start dating someone it’s normally because they passed your initial “hurdle”. The person has the right look, education, background, faith, and/or values.

For some, it only takes one date to realize “this person isn’t the one.” For others it can take 6-12-24+ months to decide yes or no. The person you are married to today is the special one. The person you grew to love more the longer you got to know them.

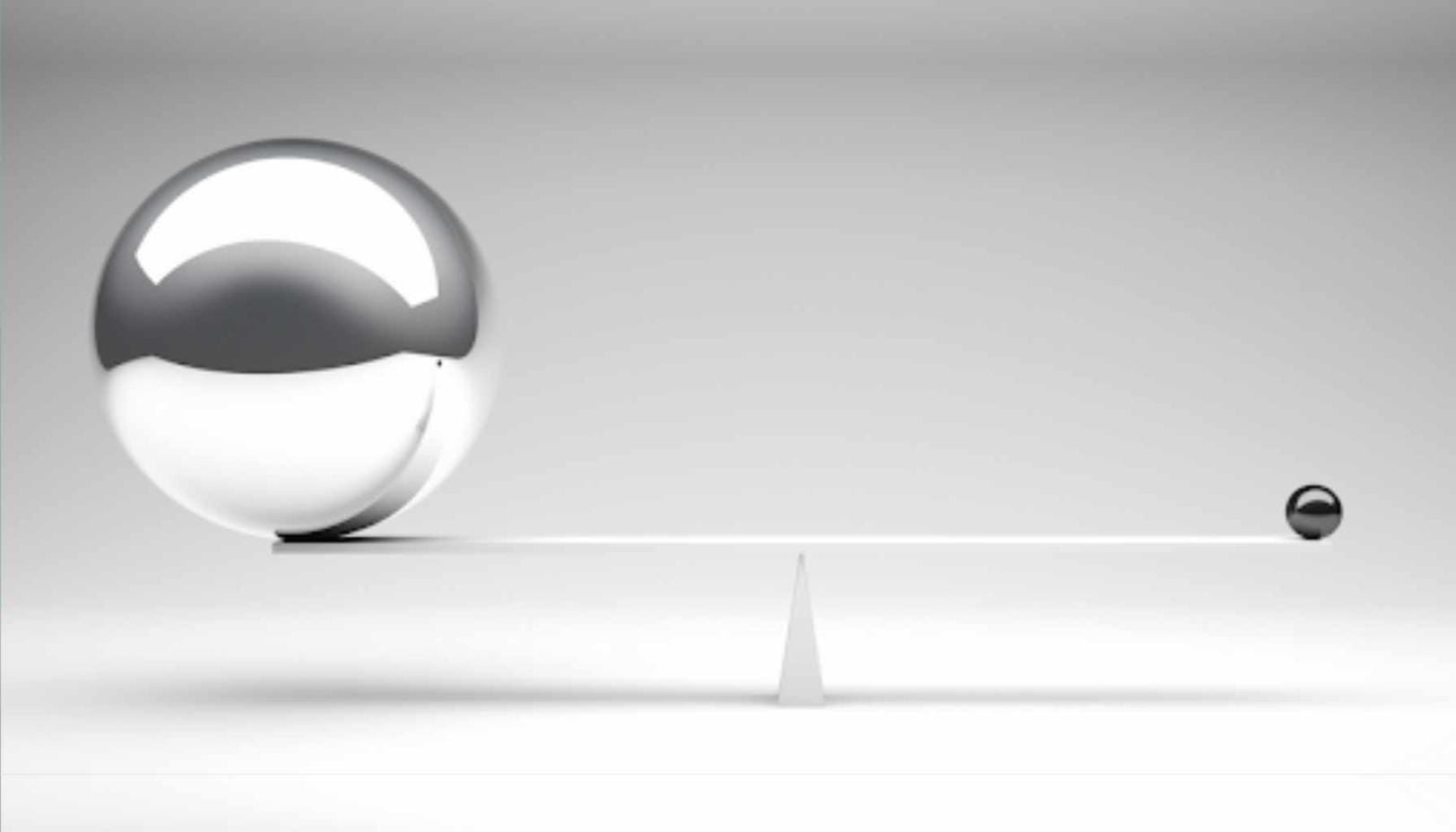

Time is a very effective hurdle. With most microcaps you will like the management, business, and situation less 6-12 months later. The special ones, the rare ones, are those you genuinely like more the longer you own them.

A year ago, we were alerted to a small obscure microcap. We quickly got on a call with management to find out their plans and intentions.

We didn’t rush it. We let the relationship develop.

Three months and several conversations later we got on a plane and spent the day with them.

Three months after that we watched them post their first profitable quarter and make a smart acquisition.

During this time we gave them advice and they listened. What we find quite often in microcap is even when we find exceptional operators doing unique things, they lack capital markets experience. They take advice from service providers or banks that are often misaligned in creating long-term shareholder value. This is where we like step in, give our advice, and help produce a positive outcome.

Admittedly, we got lucky because the stock didn't move even though the business showed substantial fundamental progress. Only after 9-months did we pull the trigger and make an investment.

This company was one of the rare ones we liked more the longer we got to know them. We had time to build the relationship. It’s the way it should be.

Time is not a luxury most microcap investors feel they have. Why?

One retail investor buying $10,000 of stock can make a situation slightly less interesting. It’s why finding a great idea in microcap before others feels so important, and why microcap investors are naturally wired for aggression.

We sprint at new ideas like it's the last cup of water in a desert. The result is most microcap investors rush into things too soon. Shoot first, ask questions later.

The truth is we over-emphasize the importance of discovery. Only on a few occasions over a 20-year career do I ever remember buying a stock where the stock immediately went up and never came back down.

Think of your own portfolio. It always feels like you’ll never get another shot to buy a company, but almost every year the market gives you another opportunity to buy that same company.

In each of the last three years I’ve been able to buy all my core holdings at similar risk adjusted prices. The stocks may have moved higher, but the risk adjusted return was even better at a higher price.

Sometimes a microcap is a better buy at a higher price as fundamentals backfill, the business becomes larger, stronger, and more diversified, and business quality increases.

In 95% of situations, you have more time than you think. Being “first’ to something isn’t as important as being right. Go on a few dates. Go on a hundred dates. Follow the company and get to know them.

The beauty of small stocks is they have a long runway when you pick the right management team and business. If you miss the first 100% of a 1000% move, does it really matter? No, not really. Chances are you will be able to buy it at a similar or better risk adjusted price anyway.

Slow down. Get to know management. The best relationships are built over time.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.