The Little Things that Result in the Big Things

How does a business get a premium valuation when they sell a commodity?

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

What if Warren Buffett would have bought ten stocks in the 1950’s, held onto them, and they all turned out to be monster winners? Like Moses coming down from the mountain with ten stocks carved in stone tablets. Isn’t this what we really want our stock picking heroes to look like? A few decisions. 10 for 10. All winners. Perfection.

His results were still spectacular. It just took some portfolio turnover.

In 1988, Warren Buffett famously said, “Our favorite holding period is forever.” Some people took the statement literally, meaning every stock he buys will be held forever. Most of us that are true students of stock picking knew what he meant. His intention is to find stocks he can hold forever, but reality is much different.

He finally got sick of people misrepresenting what he said, and in 2016 responded,

“Sometimes the comments of shareholders or media imply that we will own certain stocks “forever.” It is true that we own some stocks that I have no intention of selling for as far as the eye can see (and we’re talking 20/20 vision). But we have made no commitment that Berkshire will hold any of its marketable securities forever.”

Intentions are important in life and in stocks. Here is the difference between trading and investing:

Investing - your intention with every purchase is to hold.

Trading - your intention with every purchase is to sell.

Over the past 50+ years Buffett has owned hundreds of stocks in Berkshire’s public stock portfolio. He sold most of them very quickly. In fact, of the 230 stocks he owned between 1980 and 2010, 60% were sold in less than a year. He’s owned many for a few years. He’s owned <5% for 15+ years.

His intentions were to hold forever, but the business or macro situation changed so he sold. He still made money on many of them.

This proves what we know to be true but don’t like to admit.

All stocks have a different shelf life.

Shelf life is a term mostly used to describe the amount of time that a commodity or food can be stored without becoming unfit for consumption or sale.

We all have these types of food in our refrigerator and pantry. They all give us nourishment. They all serve a purpose. It’s the same for stocks in our portfolios. Every stock you buy has a different shelf-life.

The key difference between food and stocks is we don’t know the shelf life of a stock when we buy it. There is no one size fits all cookie cutter time frame because every business evolves in different ways. Some businesses will age like a fine wine and others like raw fish left on a kitchen counter.

No one wants to admit the right timeframe to hold a stock is different for every business and for every investor. There is no, one size fits all.

In a recent interview, @AlbertBridgeCap of Albert Bridge Capital said,

"A lot of my good friends like Guy Spier and Chris Bloomstran want to buy good companies and hold onto them. We don't. We want to know where we are versus the street over the next 2-3 years. We might own some longer. That's our whole story. Is this company going to beat numbers."

I found this statement refreshing. Drew knows exactly who he is and what he’s trying to do. He has fully developed active patience. He isn’t trying to be something he's not. He isn’t misrepresenting his strategy.

Most stock pickers define their strategy with some variation of the following:

“I do exhaustive research turning over thousands of rocks to identify a handful of wonderful businesses to buy and hold for the long-term.”

Isn’t it funny how we define our strategies by the exception and not the norm?

Like Buffett, maybe 2 out of 50 you buy might be worthy of owning 10+ years. These are the exception, not the norm. We love to define our strategy as “finding those two", but our strategies are really based on how we’ve dealt with the other 48. We can still make a lot of money on the 48. You get a lot of nutrients from eating perishable foods.

All stocks have a different shelf life.

No one likes to talk about the fact that most winning stocks only deserve to be held for 1-5 years. The ones you ultimately hold for 10+ years are wonderful, but they are the exception. Even for Buffett.

No one wants to talk about the skill of selling (aka not holding) because it’s either an admission you were wrong, or that you “don’t hold stocks forever”. Admitting you are wrong means you aren’t perfect, and no one wants to admit they aren’t perfect even though none of us are perfect. Admitting you don’t hold stocks forever just isn’t “cool” and won’t get you invited to compounder cocktail parties.

My intention with every purchase is to hold forever (5+ years), but <5% will earn that right. I’ve owned 50-60 stocks over the last 5-7 years, and I’ve owned two for 5+ years. The natural shelf life of a small microcap business on average is much shorter than mid and large cap businesses. They are smaller more volatile businesses. My average holding period is 1-2 years.

I’ve found that most winning stocks in microcap have a winning season that lasts 2-10 quarters.

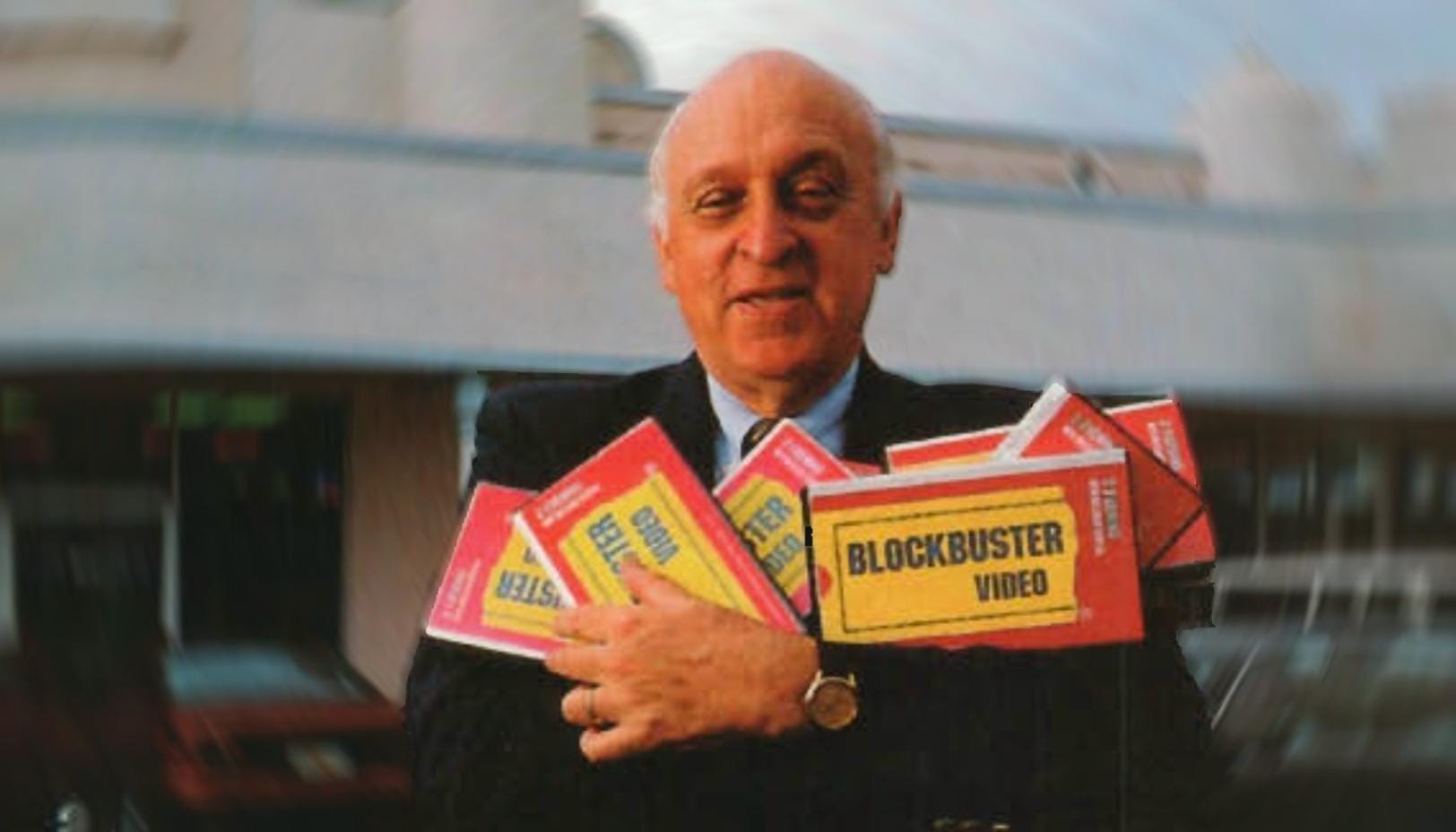

Perhaps management got lucky with product market fit for a year. Maybe it was COVID that drove demand for 12-months. Maybe it was a new regulation that increased demand. Maybe a competitor had temporary supply issues. Maybe the VP of Sales wined and dined the right executive and got the big contract. Etc. But none of it was sustainable.

Microcap Due Diligence = analyzing if management is lucky or skilled and how long it will last.

Robert Wilson was a legendary trader who turned $15,000 into $800 million over his 40-year career. He used to call himself a "long-term trader". I like that term. He would sell positions after a few days, or after a decade. He just rode them as long as they were winning.

Isn’t Wilson’s strategy closer to our reality than we want to admit?

Most small (microcap) stock pickers try way too hard to fit into this buy and hold forever camp of investing. The shelf life of most “winning” microcaps is less than 3 years. There will be exceptions that you can hold for 5+ years and hopefully much longer. But just like Buffett - they are the exceptions.

My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.

MicroCapClub is an exclusive forum for experienced microcap investors focused on microcap companies (sub $500m market cap) trading on United States, Canadian, European, and Australian markets. MicroCapClub was created to be a platform for experienced microcap investors to share and discuss stock ideas. Since 2011, our members have profiled 1000+ microcap companies. Investors can join our community by applying to become a member or subscribing to gain instant view only access. MicroCapClub’s mission is to foster the highest quality microcap investor Community, produce Educational content for investors, and promote better Leadership in the microcap arena. For more information, visit https://microcapclub.com/ and https://microcapclub.com/summit/

Get Alerted to our Next Educational Blog Post

How does a business get a premium valuation when they sell a commodity?

It's often how you react (or don't) to the same situations that shows you how much you’ve grown.

"Call Charlie a lucky man for stumbling onto Cook Data Service, but luck didn't make him a millionaire."